After raising fresh capital, Nat Habit is reworking its identity and playbook — moving from its “Fresh Ayurveda” origins to a cleaner, more structured brand built for scale.

he five-year-old D2C beauty company has raised 10.2 million dollars in a Series B round led by Bertelsmann India Investments, with Fireside Ventures, Peak XV Partners, Amazon India Fund, Mirabilis Investment Trust and Sharp Ventures participating.

When a brand built on “freshness” decides to rebrand, it’s usually not about the logo. It’s about finding space to grow.

That’s what Nat Habit is doing. The five-year-old D2C beauty company has raised 10.2 million dollars in a Series B round led by Bertelsmann India Investments, with Fireside Ventures, Peak XV Partners, Amazon India Fund, Mirabilis Investment Trust and Sharp Ventures participating.

The brand has been posting strong numbers — about 80 crore in FY24 and roughly Rs 130 crore in FY25 and Rs 250 crore annualised now. It aims to do offline expansion, a more defined omnichannel plan and steady product innovation.

The rebrand signals a shift from being a kitchen-made beauty brand to a clean, modern one. “We’re not moving away from habits. We’re evolving the emotional side of our brand,” says Swagatika Das, co-founder and CEO in an interview with BrandWagon Online. “Our products make users feel vitalised, calm and centred — alive. That’s the essence of our new communication, ‘Breathe Life.’”

The brand that once celebrated its roots in Ayurveda is now positioning itself as a lifestyle player. The product philosophy hasn’t changed. The storytelling has.

When Nat Habit started in 2019, the “natural” label was the big trend. Consumers were moving away from chemical-heavy products, and every brand was suddenly talking about herbs and purity.

That space is now crowded. “Just putting a neem leaf or strawberry on the label doesn’t cut it anymore,” says Das. “Consumers want proof of efficacy.”

Nat Habit’s approach has been to go deeper into ingredient science and consumer education. “We’ve always used 100 percent natural and fresh ingredients, but we no longer assume that people understand the ‘nutrition’ behind natural,” she adds.

Nat Habit has always leaned on transparency to build credibility, as per the company. Das says, “Simply talking about an ingredient isn’t enough. What matters is how that ingredient reaches you — unadulterated and processed right.”

The company shows its production process, right down to ingredient sourcing and blending. Its products also look visibly fresh — grainy textures, uneven colours — unlike the smooth gels most beauty brands sell.

That texture has become the proof point.

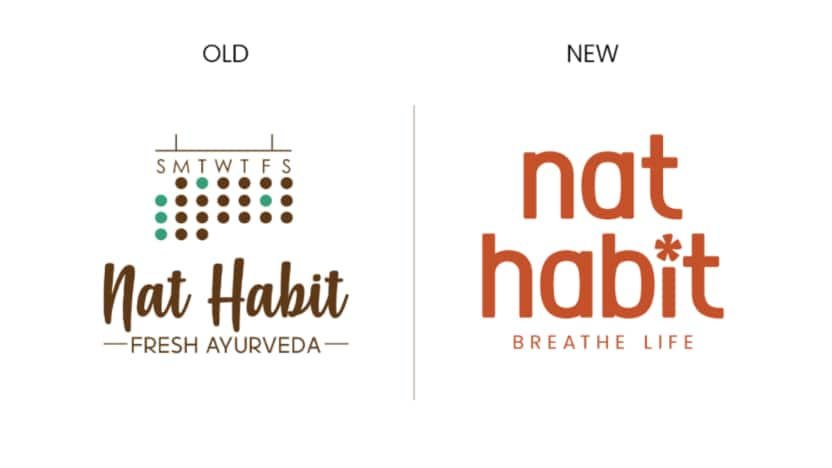

The brand’s earlier logo was handwritten, with an earthy palette that felt artisanal but somewhat dated. As per the company, the new wordmark is minimalist, lowercase and modern. A chakra-like bloom replaces the old calendar icon. Coral tones have replaced browns and greens.

“The rebrand effectively connects tradition and modernity,” says N Chandramouli, CEO of TRA Research. “It allows Nat Habit to retain authenticity while foraying into a lifestyle genre that feels global, youthful and emotionally relevant.”

But others see a trade-off. “Breaking free from ‘Fresh Ayurveda’ opens growth opportunities,” says Shubham Gune, founder of Hinglish Agency. “But in gaining flexibility, they’ve lost distinctiveness. The new look is cleaner, more scalable, yet forgettable.”

That tension between scalability and identity is one most consumer brands face once they cross the 100-crore mark.

After years of building online, Nat Habit is now in about 10,000 stores across four cities. These are mainly general stores in Class A and B markets.

Das says offline buyers are not always experimenting with new beauty habits, but awareness drives trials. “Once they notice our displays or get a sample, they’re eager to try,” she says.

The immediate focus is metros and mini-metros, roughly the top 20 cities. The next phase will likely reach the top 50 as the clean-beauty narrative moves deeper into Tier II markets.

Nat Habit spends almost entirely on digital media. There is no television, radio or print advertising. “Meta and YouTube are great for scale. Amazon works well for slightly commoditised categories. Nykaa performs best for beauty. Every small layer adds to the ROI stack,” Das says.

The strategy has moved from performance marketing to brand building. Awareness and consistency now matter more than bursts of visibility.

Das started her career far from beauty — as an engineer at Apple and Schlumberger. “I wasn’t connecting with oil and gas. I wanted to build something that touched consumers directly,” she recalls.

Her path to entrepreneurship was gradual, involving an MBA and years of consumer industry exposure. “It wasn’t an overnight decision. It was a four-year journey of clarity and conviction,” she says.

The Broader Context

Nat Habit’s transformation reflects a larger D2C pattern. Early-stage consumer brands chase discovery and speed. The next stage demands structure, profitability and long-term identity.

That transition often comes with a visual overhaul, an evolved narrative and a more institutional mindset. It’s less about novelty and more about predictability.

“Scaling beyond 500 to 1,000 crore needs brand depth and consistency,” Das notes.

Nat Habit’s rebrand is not about abandoning its roots. It is about making them relevant to a larger audience. The logo, colours and tagline are new, but the intent is the same — to make natural beauty feel contemporary rather than nostalgic.

Whether the new identity will keep its emotional core intact remains to be seen. For now, the company has managed what many D2C players struggle with: turning early credibility into a scalable, structured brand without losing its reason for being.

Empower your business. Get practical tips, market insights, and growth strategies delivered to your inbox

By continuing you agree to our Privacy Policy & Terms & Conditions