India’s $75 bn wedding industry is growing 7–8% annually, driven by rising incomes, celebrity influence, and luxury demand, making it a key driver for fashion, hotels, autos, and tourism.

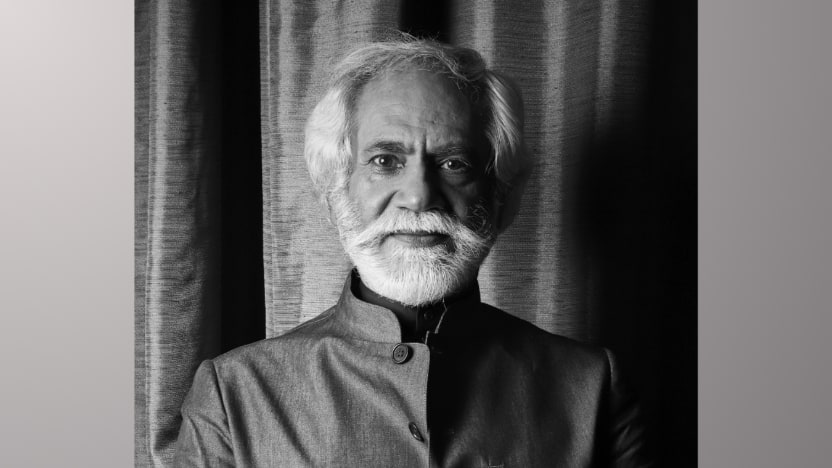

Sunil Sethi, Chairman, Fashion Design Council of India (FDCI),

In India, weddings have quietly become one of the biggest consumption triggers. They decide where money flows, which brands matter, and how luxury gets defined. From couture to cars to hotels, the ripple effect is hard to ignore. No surprise then that the wedding industry in India is growing at 7–8% year-on-year, reaching close to $75 billion during the 2023–24 season. This marks a steady recovery after the pandemic.

“Weddings in India have always been significant,” Sunil Sethi, Chairman, Fashion Design Council of India (FDCI), told BrandWagon Online. A survey of 3,000–4,000 couples and over 500 vendors indicates a 15–20% rise in business from 2022 to 2024, positioning weddings as one of the country’s most resilient sectors.

The FDCI, a non-profit promoting Indian fashion since 1998, recently partnered with Manifest to host the third edition of the FDCI Manifest Wedding Weekend. The event brought together 46 designers, jewellers, and brands in one platform.

What’s driving the momentum? “Luxury is growing,” said Sethi. “We launched the wedding weekend three years ago because the market was expanding.” More than Rs 600 crore is spent annually on hotel bookings for weddings, with destination weddings contributing to tourism and local businesses.

Consumer behaviour is also shifting. “The modern Indian bride calls the shots, and grooms are increasingly engaged too,” Sethi said. This trend has supported men’s fashion growth. Rising household incomes, social aspirations, and higher discretionary spending are adding to the demand for elaborate weddings.

Also Read: Turkey’s big fat Indian wedding market stares at a Rs 770 cr loss

Celebrity weddings are influencing choices, encouraging larger budgets and scale. Government initiatives promoting ‘Wedding India’ are also encouraging couples to marry within the country instead of opting for international venues.

Market estimates suggest that the luxury wedding segment could reach $80–90 billion by 2030, driven by the expanding middle class and growing demand from tier two and three cities. Car sales are also being linked to the trend, with brands like Mercedes and Hyundai seeing demand tied to weddings.

Sethi added that exclusive wedding collections are scheduled to launch in August, with luxury malls expanding beyond Delhi and Mumbai, and multiple stakeholders participating in the wedding economy.

The FDCI Wedding Weekend focuses on detailed curation of lighting, food, seating, and collections from across Indian cities. The event operates on an invite-only basis and does not engage sponsors, relying instead on industry participation and word-of-mouth.

“We haven’t changed the formula. In America, they say if it ain’t broke, why fix it?” Sethi said.

India’s wedding market is evolving with scale and organisation, positioning itself as a key driver for fashion, luxury, and related industries.

Empower your business. Get practical tips, market insights, and growth strategies delivered to your inbox

By continuing you agree to our Privacy Policy & Terms & Conditions